| NET INCOME Board Diversity | EBITDA

EX. IDENTIFIED ITEMS* | Board Refreshment (since 2018) | RETURNED TO SHAREHOLDERS | | |  | |  |

LYONDELLBASELL 2021 PROXY STATEMENT 8

2020 PERFORMANCE OVERVIEW

* In 2020, the pandemic and market headwinds resulted in a challenging year, as lower demand impacted volumes and margins leading to significantly decreased EBITDA across nearly all parts of our business. Against that backdrop, however, the Company continued to operate efficiently and safely, and we capitalized on opportunities to grow and invest in our future.

$1.4B | $3.9B | $1.4B | NET INCOME | EBITDA

EX. LCM & IMPAIRMENT* | DIVIDENDS PAID |

* See Appendix A for information about our non-GAAP financial measures and a reconciliation of net income to EBITDA, including and excluding adjustments.identified items. Identified items include adjustments for impairments and refinery exit costs.

| GROWTH | Invested efficiently for long-term returns, advancing two new joint ventures in China and acquiring a 50% stake in a new integrated polyethylene joint venture in Louisiana | |  | LIQUIDITY | Increased liquidity through aggressive inventory reductions and an actively managed balance sheet | | |   | SAFETY | Achieved top-decile safety performance while implementing new COVID-19 protocolsCASH

GENERATION | Maintained robust cash generation from operating activities, driven by diverse business portfolio | |  | | STRONG

BALANCE SHEET | Maintained a strong, investment-grade balance sheet and socially distanced operations | |  | MARKET POSITION | Maintained leading market positions through nimble reaction from commercial groupsample liquidity |   | | SAFETY | Achieved outstanding safety results, including record occupational safety scores | |  | | SHAREHOLDER

RETURNS | 12th consecutive year of regular dividend growth, including a $1.7 billion special dividend |  | | COST DISCIPLINE | DemonstratedBalanced cost discipline in day-to-day operationsmanagement with long-term strategies to capture value and accelerate growth | |  | | SUSTAINABILITY | Announced new climate ambition to reduce Scope 3 emissions by deferring non-safety-related capital expenditures | |  | SUSTAINABILITY | Progressed sustainability programs and goals, including new recycling targets, and joined the United Nations Global Compact30% by 2030, compared to a 2020 baseline |

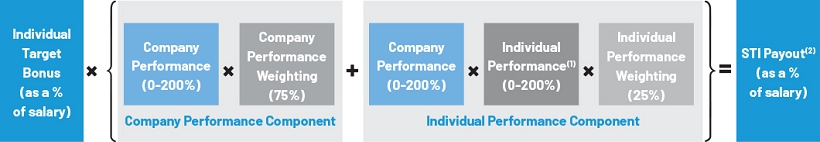

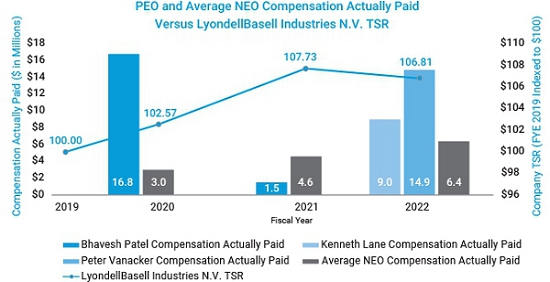

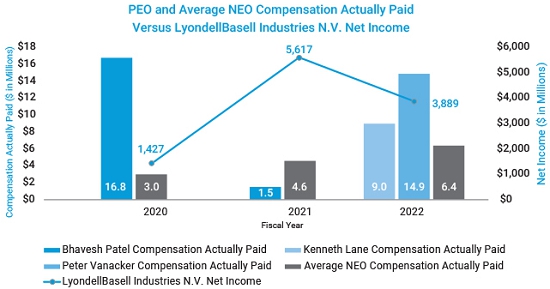

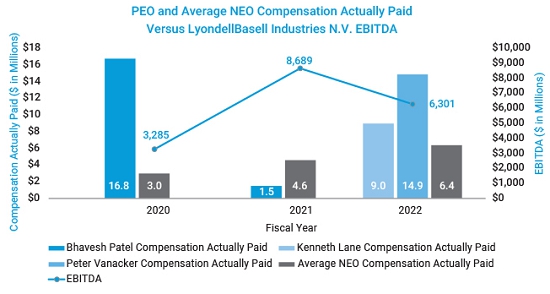

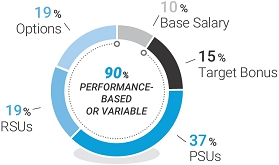

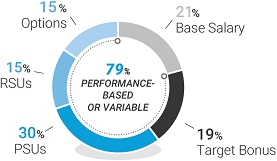

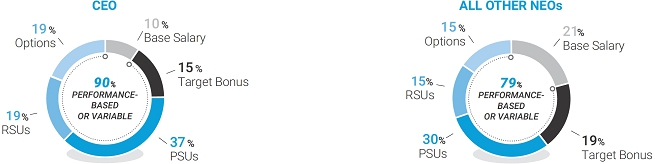

2022 EXECUTIVE COMPENSATION HIGHLIGHTSWe are committed to a pay for performance philosophy, and our compensation programs align executive and shareholder interests by tying a significant amount of compensation to our financial, business, and strategic goals. The compensation ofChallenging market conditions impacted EBITDA, but our CEOstrong safety, cost and other Named Executive Officers is heavily weighted toward performance-based and variable compensation. CEO | | ALL OTHER NEOs | | | |  | |  |

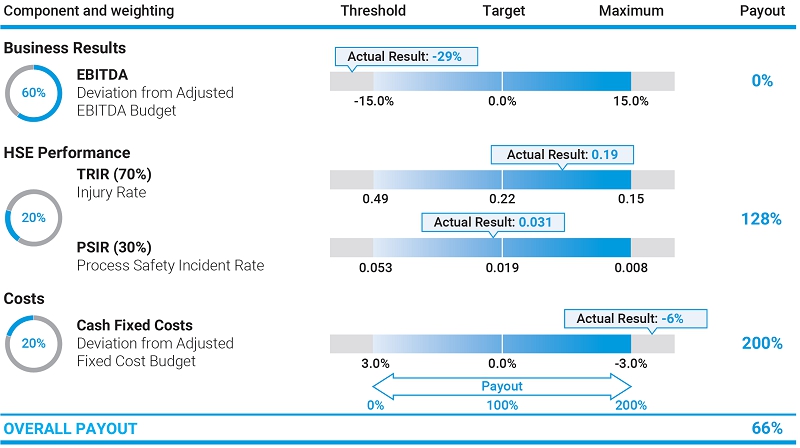

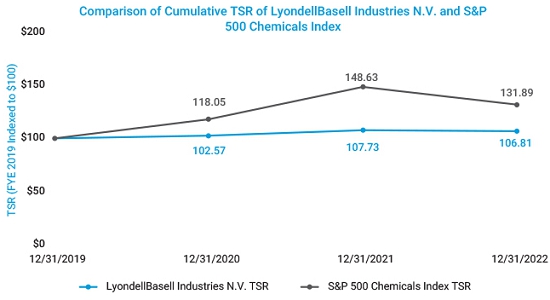

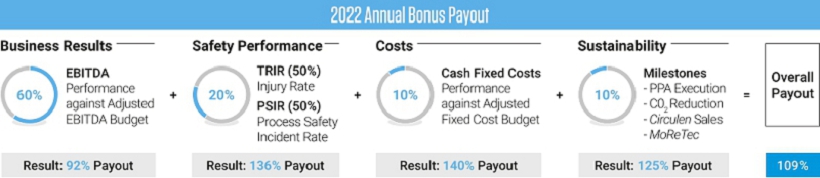

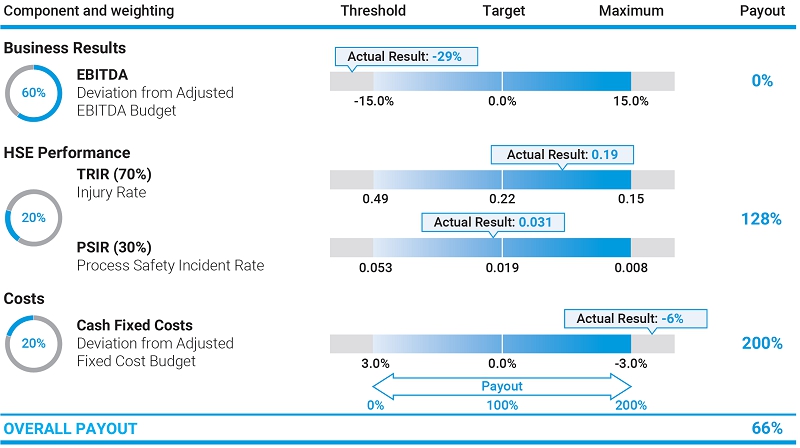

Due to the COVID-19 pandemic and difficult market environmentsustainability performance resulted in 2020, and resulting EBITDA performance, annual bonuses for our executives paid out belowpaying slightly above target. Similarly, total shareholder returns over recent years resulted in no payout for the 2018-2020Our performance share units (“PSUs”) granted in 2020 under our long termlong-term incentive program.program, with a three-year performance period ended December 31, 2022, earned 100% of target, reflecting the fact that our total shareholder return (“TSR”) matched the median TSR of selected peers. For PSUs granted in 2021, 2022 and 2023, payout will be based 50% on relative TSR (formerly our sole performance metric) and 50% on free cash flow per share. For more information on our annual bonus performance metrics, see “2022 Executive Compensation Decisions in Detail” on page 50.

LYONDELLBASELL 2021 PROXY STATEMENT 9Our Compensation and Talent Development (“C&TD”) Committee continually monitors compensation best practices, the effectiveness of our compensation programs, and their alignment with our compensation philosophy.

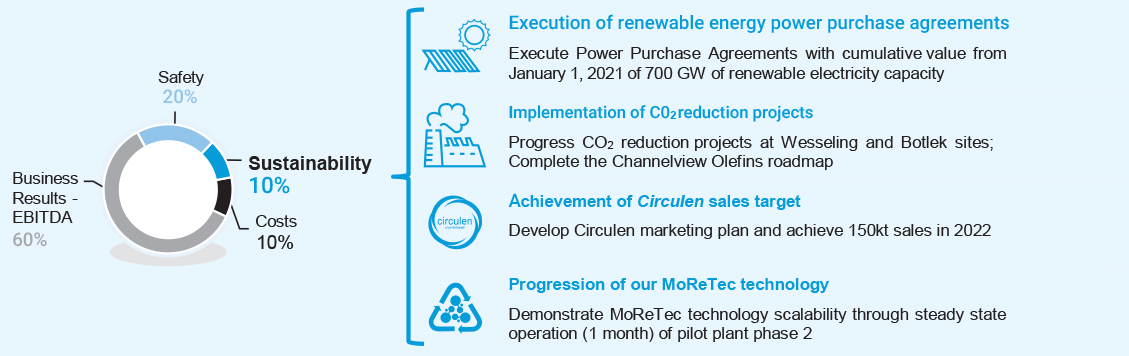

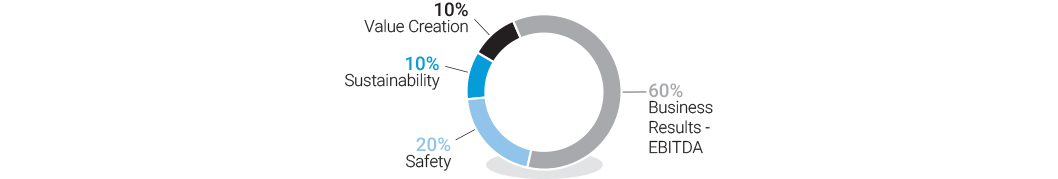

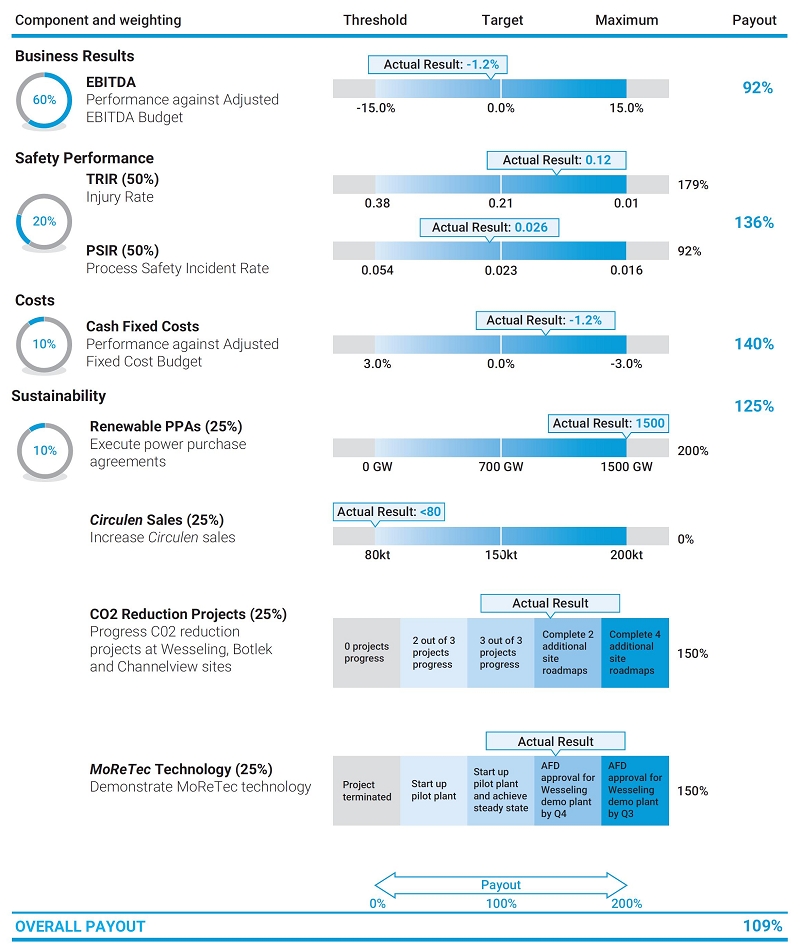

ESG-RELATED METRICS FOR ANNUAL BONUS | 30% of our annual bonus payout for 2022 was tied to ESG results (20% Safety and 10% Sustainability). Our focus on safety was rewarded by a step change in occupational safety performance. We achieved a record low for our total recordable incident rate (“TRIR”), and 55 of our sites achieved GoalZERO. The payout under our sustainability metric was based on achievement of key milestones supporting our sustainability goals: (1) execution of renewable electricity power purchase agreements (“PPAs”), (2)implementation of C02 reduction projects, (3) sales of Circulen products, and (4)progression of our MoReTec technology. |  |

LYONDELLBASELL 2023 PROXY STATEMENT 9

Back to Contents ITEM 1 ELECTION OF DIRECTORSITEM 1 | ELECTION OF DIRECTORS |

| The Board recommends that you vote FOR the election of each of the nominees to our Board of Directors. |

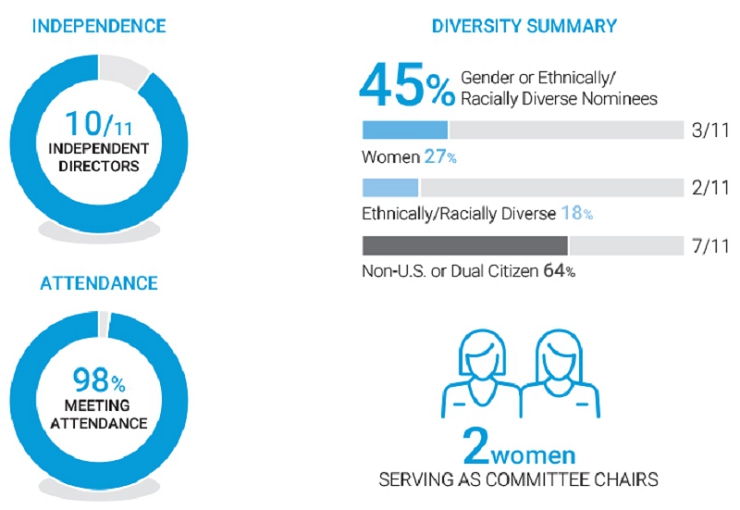

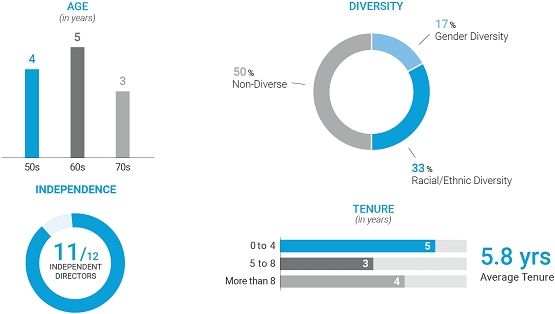

The Board of Directors of LyondellBasell Industries N.V. (“LyondellBasell” or the “Company”) recommends that each of the twelveeleven director nominees introduced below be elected to our Board, in each case for a term ending at our 20222024 annual general meeting of shareholders. The nominees include ten current directors, who were elected by shareholders at the 20202022 annual general meeting, and two new director nominees, Tony Chasecandidate Rita Griffin. Jagjeet Bindra and Bob Dudley.Nance Dicciani have reached our mandatory retirement age and are not standing for re-election. Our Nominating and Governance Committee, together with its outside search firm, is continuing to evaluate potential director candidates to fill the remaining vacancy created by the retirements of Mr. Bindra and Ms. Dicciani. If a leading candidate is identified prior to the Company’s next general meeting of shareholders, the Board intends to appoint a director to serve as a temporary replacement for the partial-year term ending at the next general meeting. OUR BOARDOur goal is to have a Board that provides effective oversight of the Company through the appropriate balance of experience, expertise, skills, competencies, specialized knowledge, and other qualifications and attributes. Director candidates also must be willing and able to devote the time and attention necessary to engage in relevant, informed discussion and decision-making. Our Nominating and Governance Committee focuses on Board succession planning and refreshment and is responsible for recruiting and recommending nominees to the full Board for election. The Committee considers the qualifications, contributions, and outside commitments of each current director in determining whether he or she should be nominated for reelection. Many of our directors serve on the boards and board committees of other companies, and the Committee believes this service provides additional experience and knowledge that improve the functioning of our own Board. Our Board Profile, which is available on our website, provides general principles for the composition, expertise, background, diversity and independence of the Board and guides our Nominating and Governance Committee on the nomination and appointment of directors. Our Board considers diversity a priority and seeks representation across a range of attributes, including race, gender, ethnicity, nationality, and gender.nationality. Our Board isremains committed to increasing the representation of women in its membership.membership and targets at least one-third female directors, alongside continued focus on increasing the racial and ethnic diversity of the Board. While we have not yet achieved our goal of at least one-third female directors, which was originally targeted by 2023, our current director nominees include three women. Our Nominating and Governance Committee is continuing to evaluate candidates to fill the vacancy on our Board following our 2023 annual general meeting. In accordance with our Corporate Governance Guidelines, the Committee and any outside consultantssearch firms engaged to assist in identifying potential director candidates include women and minority candidates in each pool from which a director candidate is selected. These recruitment efforts are evidenced by our current Board composition and the qualities and qualifications of each of our nominees. DIRECTOR NOMINEES’ INDEPENDENCE, TENURE, AND DIVERSITYOur director nominees provide the Board with a broad range of perspectives due to their diverse gender, age,race, ethnicity, nationality, age, and tenure profiles, as well as the qualifications and skills identified below. Each of the eleventen non-executive directors nominated to our Board is independent.

Our Nominating and Governance Committee recognizes This section provides information on our director nominees for the importance of regular2023 annual general meeting. For more information about our current Board refreshment to provide new perspectives, skill sets, and diversity to its membership. Since 2018, the Board has nominated five new directors for election, elected a new independent Chair, appointed new Chairsas of the Auditdate of this proxy statement, see “Board and Committee and Compensation and Talent Development Committee (including promoting a second womanInformation” on page 29.

LYONDELLBASELL 2023 PROXY STATEMENT 10

Back to a Board leadership position), and regularly rotated Committee member appointments.Contents LYONDELLBASELL 2021 PROXY STATEMENT 10

DIRECTOR EXPERIENCE AND EXPERTISE |  | Aigrain |  | Benet |  | Bindra |  | Buchanan |  | Chase | | Cooper | | Dicciani | | Dudley | | Farley | | Hanley | | Manifold | | Patel |   | | INDUSTRY EXPERIENCE

Experience with and understanding of the chemicals and refining industries | | | ● | | ● |  ● | ● |  | ● | | |  | |  | |  | |  | | | | | |  ● |   | | HSE EXPERIENCE

Experience with social responsibility issues related to health, safety, and

the environment | | | | ● | ● |  ● | ● | ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | STRATEGIC PLANNING

Knowledge of corporate strategy and strategic planning | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | MERGERS & ACQUISITIONS

Experience with mergers, acquisitions, and other strategic transactions | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | CORPORATE FINANCE

Financial expertise and experience with corporate finance | ● |  ● | ● |  ● | ● | ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | EXECUTIVE MANAGEMENT / CEO EXPERIENCE

Executive management experience with large or international organizations | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | CORPORATE GOVERNANCE

Knowledge of corporate governance issues applicable to companies listed on the NYSE | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | RISK MANAGEMENT

Experience identifying, managing, and mitigating key enterprise risks | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● |   | | PUBLIC COMPANY DIRECTOR

Service on the boards of other public companies | ● |  ● | ● |  ● | ● |  ● | ● |  ● | ● |  ● | |  | |  | |  | |  | |  | |  | |  ● | DIVERSITY AND DEMOGRAPHICS | | | | | | | | | | | | Race/Ethnicity | | | | | | | | | | | | African American or Black | | | | ● | | | | | |  | | | | | | | | | | | | | | | Alaskan Native or American Indian | | | | | | | | | | | | | | | | | | | | | | | | | Asian | | | | | |  | | | | | | | | | | | | | | | | | |  | Caucasian or White | ● |  | ● | | ● | ● | |  ● | ● | ● | |  | |  | |  | |  | |  | |  | | ● | Hispanic or LatinxLatino | | ● | |  | | | | | | | | | | | | | | | | | | | | | Native Hawaiian or Pacific Islander | | | | | | | | | | | | | | | | | | | | | | | | | Gender | | | | | | | | | | | | Male | ● |  ● | ● |  ● | ● |  | |  ● | |  ● | |  | | | |  | | | |  | |  | |  ● | Female | | | | | | ● | ● | | ● | | | | | |  | | | |  | | | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 11

LYONDELLBASELL 2023 PROXY STATEMENT 11

Back to Contents DIRECTOR NOMINATIONSBackAlthough our Nominating and Governance Committee is responsible for recommending director candidates to Content the Board, candidates may also be proposed by other directors, management, and our shareholders. From time to time, the Committee works with outside search firms to assist with identifying and evaluating director candidates.A shareholder who wishes to recommend a director candidate should submit a written recommendation to our Corporate Secretary by email or regular mail. The recommendation must include the name of the nominated individual, relevant biographical information, and the individual’s consent to be nominated and to serve if elected. Our Nominating and Governance Committee uses the same process to evaluate shareholder nominees as it does in evaluating nominees identified by other sources. For our 2024 annual general meeting of shareholders, recommendations must be received by December [__], 2023 to be considered. | |

DIRECTOR NOMINATIONS

Although our Nominating and Governance Committee is responsible for recommending director candidates to the Board, candidates may also be proposed by other directors, management, and our shareholders.

Any shareholder who wishes to recommend a director candidate should submit a written recommendation to our Corporate Secretary by email or regular mail. The recommendation must include the name of the nominated individual, relevant biographical information, and the individual’s consent to nomination.

| |  |  |  BY EMAIL | send an email to

CorporateSecretary@

LyondellBasell.com

CorporateSecretary@LyondellBasell.com | |  BY MAIL | | LyondellBasell Industries N.V.

c/o Corporate Secretary

4th

4th Floor, One Vine Street

London W1J 0AH, United Kingdom |

Our Nominating and Governance Committee uses the same process to evaluate shareholder nominees as it does in evaluating nominees identified by other sources. For our 2022 annual general meeting of shareholders, recommendations must be received by December 17, 2021 to be considered.

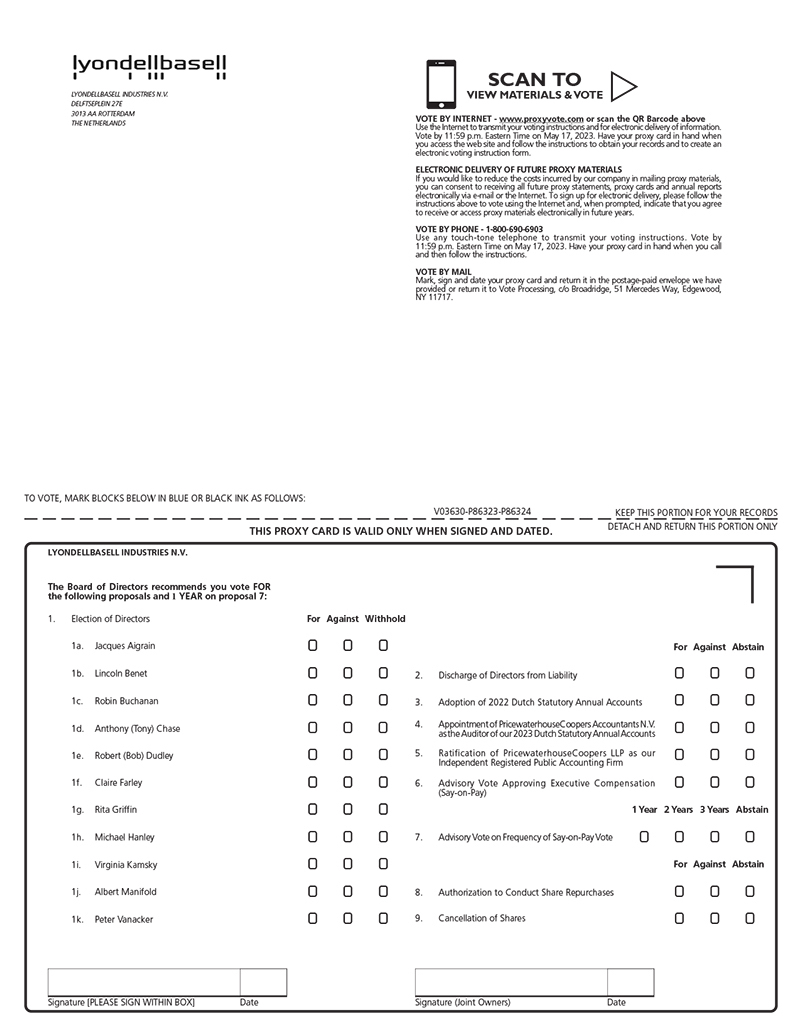

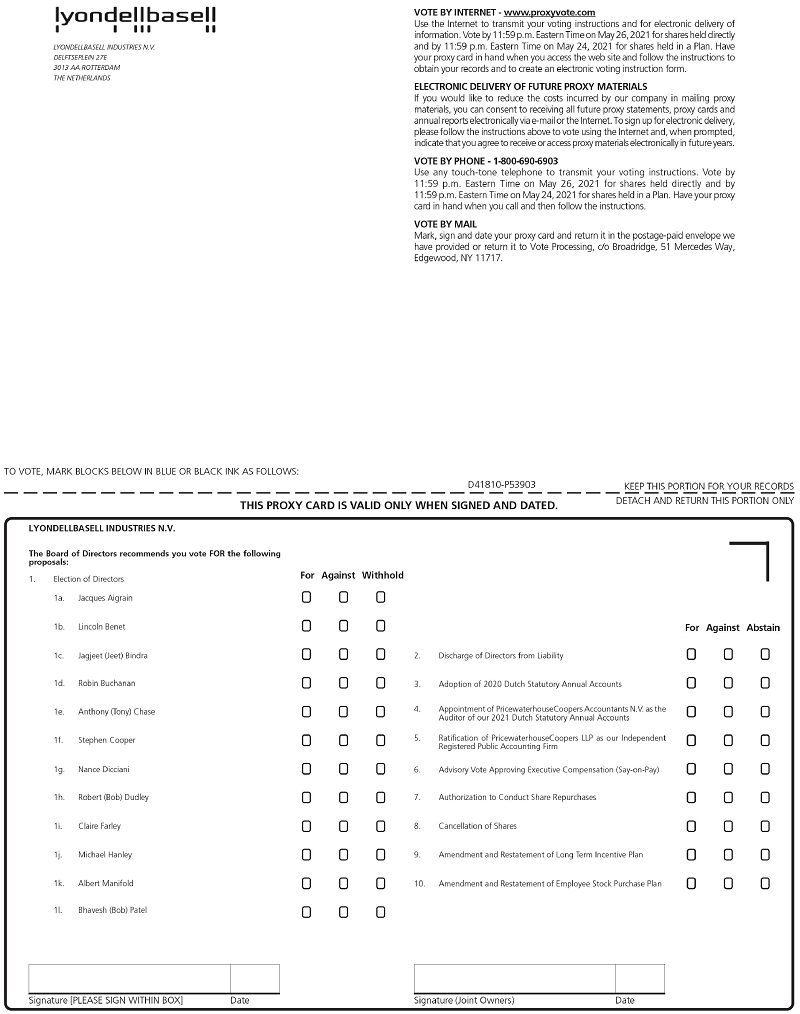

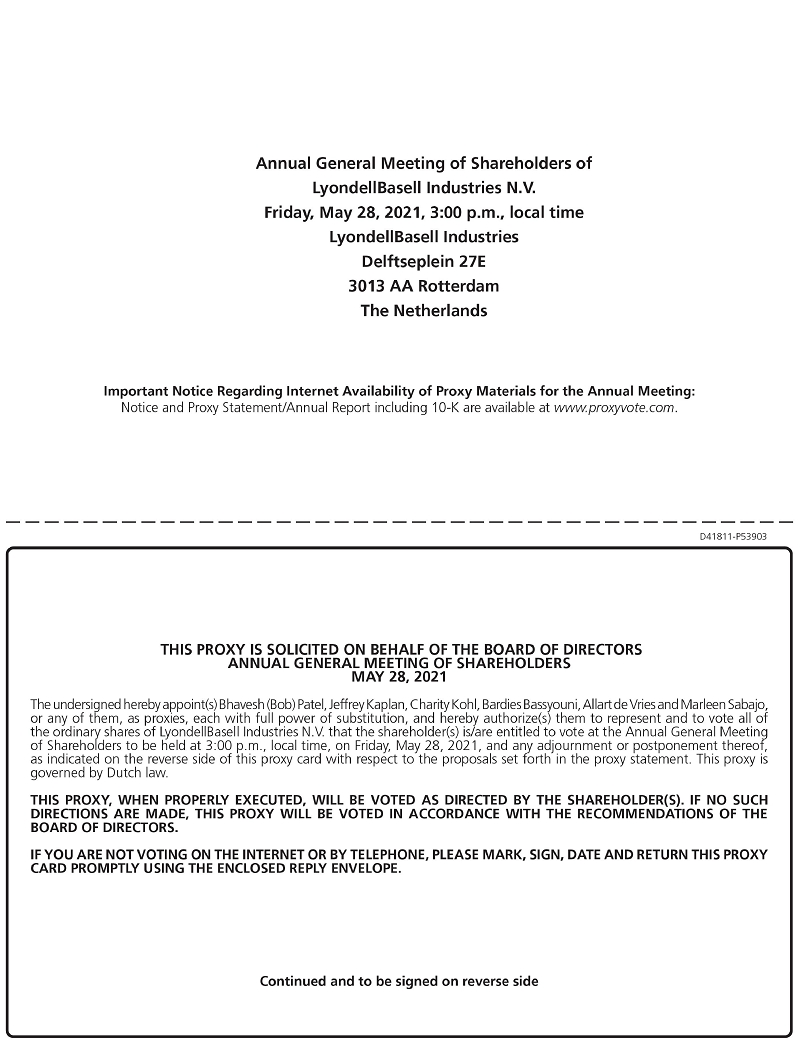

2023 NOMINEES TO THE BOARDOn the recommendation of the Nominating and Governance Committee, the Board has nominated ten continuing directors elected by shareholders at our 2022 annual general meeting and twoone new director nominees, Tony Chase and Bob Dudley, for election to the Board.nominee, Rita Griffin. These twelveeleven individuals have a high caliber and diverse array of expertise, experience, and leadership skills. Each of these nomineesnominee has consented to serve as a director if elected. Bella Goren isJagjeet Bindra and Nance Dicciani are not standing for re-election following the completion of her current term at the 2021 annual general meeting (the “Annual Meeting”).as they have reached our mandatory retirement age. We introduce our twelveeleven nominees below. All Committee memberships shown in this section will be effective following the 2023 annual general meeting. For more information about our current Board and Committee membership as of the date of this proxy statement, see “Board and Committee Information” on page 29. JACQUES AIGRAIN |

Age 66 68 French-Swiss Non-Executive

Director

since 2011;

Chair since 2018

INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Mr. Aigrain is our Chair of the Board and a retired Senior Advisor and Partner of Warburg Pincus, a global private equity firm. Prior to joining Warburg Pincus in 2013, Mr. Aigrain served as Chief Executive Officer of Swiss Re, a publicly traded insurance company, and was Co-Global Head of M&A and Head of Financial Institutions at J.P. Morgan. He also has many years of experience as a director of public and multinational organizations, including The London Stock Exchange Group plc and WPP plc, a multinational advertising and public relations company, and currently, Clearwater Analytics Holdings Inc., a maker of financial software products, and TradeWeb Markets Inc., an international financial services company. Mr. Aigrain’s more than 30 years of financial services and management experience provide him with expertise in all areas of strategy, mergers and acquisitions, finance, and capital markets. Additionally, he brings substantial knowledge of board- and governance-related matters. | | COMMITTEES | | • COMMITTEES

•Nominating and Governance Committee

• •Executive Committee (Chair)

| | | | SKILLS AND QUALIFICATIONS | • •International Operations

| • •Public Company Director Experience

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS | FORMER PUBLIC DIRECTORSHIPS | • Clearwater Analytics Holdings Inc. (since 2021) • TradeWeb Markets Inc. (since 2022) | • The London Stock Exchange Group plc (since 2013)(2013-2022) • •WPP plc (since 2013)(2013-2022)

| | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 12

LYONDELLBASELL 2023 PROXY STATEMENT 12

Back to Contents LINCOLN BENET |

Age 57 59 American-British Non-Executive Director since 2015 INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Mr. Benet has served as Chief Executive Officer of Access Industries, a privately held industrial group with world-wide holdings, since 2006. Prior to joining Access, he spent 17 years at Morgan Stanley, including as Managing Director. Mr. Benet also has experience serving on the boards of several privately held and publicly traded companies, including those in the investment, music and publishing, oil and gas pipes and tubing, cement, sports media, and petrochemicals industries. As a result of this background, he brings to our board a working knowledge of global markets, mergers and acquisitions, executive management, strategic planning, and corporate strategy, as well as experience with international finance, including corporate finance matters such as treasury, insurance, and tax. | | COMMITTEES | | • COMMITTEES

•Nominating and Governance Committee

• •Finance Committee (Chair)

| | | | SKILLS AND QUALIFICATIONS | • •International Operations

| | | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS | • •Warner Music Group Corp. (public(since 2011; public since 2020)

| | | | | |

JAGJEET (JEET) BINDRA |

Age 73

American

Non-Executive

Director

since 2011

INDEPENDENT

| | BIOGRAPHY

Mr. Bindra is a retired executive of Chevron, a multinational energy corporation, where he spent 32 years in senior leadership positions and retired as President of the company’s worldwide manufacturing operations. Mr. Bindra holds a degree in chemical engineering and started his career at Chevron as a research engineer before progressing to increasingly senior positions, including the roles of Manager of Strategic Planning and Group Manager of Projects & Engineering Technology. His education and background provide him with extensive knowledge of global manufacturing, capital project management, engineering technology, strategic business planning, and health, safety, and environmental and operations matters. Mr. Bindra has served as a director of multiple private and publicly traded companies, including Edison International and its subsidiary, Southern California Edison, WorleyParsons, and Transocean Ltd., and he has broad knowledge of board and governance matters. Mr. Bindra currently serves as a member of the board of HPCL-Mittal Energy Limited (India).ROBIN BUCHANAN

| | | | COMMITTEES

• Audit Committee

• HSE&O Committee (Chair)

• Executive Committee

| | | | SKILLS AND QUALIFICATIONS

• Industry Experience

• Capital Project Execution

• Executive Management

• Corporate Governance

• Mergers & Acquisitions

| • HSE Experience

• Strategic Planning

• International Operations

• Risk Management

• Public Company Director Experience

| | | | | FORMER PUBLIC DIRECTORSHIPS

• Edison International / Southern California Edison Co. (2010-2017)

• WorleyParsons (2015-2017)

| | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 13

ROBIN BUCHANAN |

Age 69 71 British Non-Executive Director since 2011 INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Mr. Buchanan has previously served as Dean and President of London Business School, the Chairman of PageGroup plc, a global specialist recruitment company, a director of Schroders plc, a global asset management firm, a director of Cicap Ltd, a global private equity firm, and a director of Bain & Company Inc., a global business consulting firm. As the former UK Senior Partner, he continues to serve in an advisory role to Bain. Mr. Buchanan also serves as an advisor to Access Industries and Non-Executive Chairman of its Advisory Board, which advises on portfolio strategy. Mr. Buchanan’s experience as a board member of publicly traded, private, and charitable companies, Dean of a leading Business School, and long tenure with Bain provide him with deep experience in strategy, leadership, board effectiveness, business development, and acquisitions across most industry sectors, including considerable involvement with chemicals and energy in Europe. He also brings a wealth of experience in board and governance matters, particularly as related to multi-national companies. Mr. Buchanan is a Chartered Accountant and a published author on strategy, acquisitions, leadership, board effectiveness, corporate governance, and compensation. | | COMMITTEES | | • COMMITTEES

• CompensationHealth, Safety, Environmental, and Talent DevelopmentSustainability (“HSE&S”) Committee

• •Nominating and Governance Committee

| | | | SKILLS AND QUALIFICATIONS | • •International Operations

| • •Public Company Director Experience

| | | | | FORMER PUBLIC DIRECTORSHIPS | • •Schroders plc (2010-2019)

| | | | | |

LYONDELLBASELL 2023 PROXY STATEMENT 13

Back to Contents ANTHONY (TONY) CHASE |

Age 66 68 American Non-Executive Director since 2021 Director NomineeINDEPENDENT

INDEPENDENT

| | BIOGRAPHY | Mr. Chase is the Chairman and Chief Executive Officer of ChaseSource, L.P., a Houston-based staffing, facilities management, and real estate development firm founded by him in 2006 and recognized as one of the nation’s largest minority-owned businesses by Black Enterprise Magazine. Prior to ChaseSource, Mr. Chase founded and sold three successful ventures: Chase Radio Partners, Cricket Wireless and ChaseCom. He is also a principal owner of the Marriott Hotel at George Bush Intercontinental Airport in Houston and the Principle Toyota dealership in greater Memphis. He currently serves as a director of Cullen/Frost Bankers, a financial holding company, Nabors Industries, an operator of drilling rig fleets and provider of offshore platform rigs, and Heritage-Crystal Clean, a providerPar Pacific Holdings, Inc., an oil and gas exploration and production company. Mr. Chase chairs the City of full-service parts cleaning, waste,Houston/Harris County COVID-19 Relief Fund and used oil collection services. Mr. Chaseco-chaired the City of Houston/Harris County Hurricane Harvey Relief Fund. He is also a tenured Professor of Law Emeritus at the University of Houston Law Center, a member of the Council on Foreign Relations, and serves on the board of numerous Houston-based non-profits including the Houston Endowment, the Greater Houston Partnership, the Greater Houston Community Foundation, the M.D. Anderson Board of Visitors, and the Texas Medical Center. He previously served as Deputy Chairman of the Federal Reserve Bank of DallasDallas. Mr. Chase is an honors graduate of Harvard College, Harvard Law School and ChairmanHarvard Business School. He has received many awards, including the American Jewish Committee’s 2016 Human Relations Award, Houston Technology Center’s 2015 Entrepreneur of the Greater Houston Partnership.Year, NAACP 2013 Mickey Leland Humanitarian Award, GHP 2013 Bob Onstead Leadership Award, the 2012 Whitney M. Young Jr. Service Award, Ernst & Young’s Entrepreneur of the Year Award, Bank of America’s Pinnacle Award and UH Law Center’s Baker Faculty Award. He is also an Eagle Scout. Mr. Chase has deep entrepreneurial experience as the founder of ChaseSource and three otherfour successful ventures, as well as extensive experience serving on public company boards and in related governance matters.corporate governance. | | | | COMMITTEES • Audit Committee (effective as of Annual Meeting)

• Compensation and Talent Development Committee (effective as of Annual Meeting)

| | | | SKILLS AND QUALIFICATIONS | | • •Public Company Director Experience

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS | FORMER PUBLIC DIRECTORSHIPS | • Nabors Industries Ltd. (since 2019) • •Cullen/Frost Bankers, Inc. (since 2020)

• • Heritage-Crystal Clean,Par Pacific Holdings, Inc. (since 2020)2021)

| • FORMER PUBLIC DIRECTORSHIPS

•Anadarko Petroleum Corp. (2014-2019)

• •Paragon Offshore plc (2014-2017)

• Heritage-Crystal Clean, Inc. (2020-2022) | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 14

STEPHEN COOPER |

Age 74

American

Non-Executive

Director

since 2010

INDEPENDENT

| | BIOGRAPHY

Mr. Cooper has served as Chief Executive Officer and Director of Warner Music Group Corp., a recorded music and music publishing business, since 2011. He has also been a Managing Partner of Cooper Investment Partners, a private equity firm specializing in underperforming companies, since 2008. In the course of a long career as a financial advisor and corporate turnaround specialist, Mr. Cooper has served as the top executive of a number of publicly traded companies, including as Chief Executive Officer of Metro-Goldwyn-Mayer, Inc., a media company focused on film and television, and Hawaiian Telecom, the dominant telecom services provider in Hawaii. Mr. Cooper has expansive knowledge and experience relating to all matters of executive management, finance, and strategy, and due to his role as a sitting CEO he has deep insight into day-to-day business, management, and strategy issues.ROBERT (BOB) DUDLEY

| | | | COMMITTEES

• HSE&O Committee

| | | | SKILLS AND QUALIFICATIONS

• Strategic Planning

• Risk Management

• Capital Markets

• Corporate Finance

• International Operations

• Corporate Governance

| • Mergers & Acquisitions

• Industry Experience

• CEO Experience

• HSE Experience

• Public Company Director Experience

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS

• Warner Music Group Corp. (public since 2020)

| | | | | |

NANCE DICCIANI |

Age 73 American

Non-Executive

Director

since 2013

INDEPENDENT

| | BIOGRAPHY

Ms. Dicciani is a retired senior executive and chemical engineer. She spent her early career in research and development at Air Products and Chemicals, and then joined Rohm and Haas, a specialty chemicals manufacturer, as business director for the Petroleum Chemicals Division. After 10 years with Rohm and Haas in which she rose to the level of Senior Vice President, Ms. Dicciani became President and Chief Executive Officer of Honeywell Specialty Materials, also a chemicals manufacturer. Ms. Dicciani served on the Executive Committees of the American Chemistry Council and the Society of Chemical Industry and was appointed by George W. Bush to the President’s Council of Advisors on Science and Technology. Her background provides her with specific industry knowledge and an understanding of manufacturing, health, safety, and environmental matters; insight into the competitive landscape relevant to our industry; and a wealth of experience in all areas of executive management. Ms. Dicciani also has extensive experience in board and governance matters and has served as a director of several public companies, including Halliburton, an oilfield services company, and Linde, an industrial gases company.

| | | | COMMITTEES

• Compensation and Talent Development Committee (Chair)

• Finance Committee

• Executive Committee

| | | | SKILLS AND QUALIFICATIONS

• Industry Experience

• HSE Experience

• Capital Project Execution

• Mergers & Acquisitions

• Capital Markets

• Public Company Director Experience

| • International Operations

• CEO Experience

• Strategic Planning

• Risk Management

• Corporate Finance

• Corporate Governance

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS

• Halliburton Company (since 2009)

• AgroFresh Solutions, Inc. (since 2015)

• Linde plc (since 2018)

| FORMER PUBLIC DIRECTORSHIPS

• Praxair, Inc. (2008-2018)

| | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 15

ROBERT (BOB) DUDLEY |

Age 65

67 American-British Non-Executive Director since 2021 Director NomineeINDEPENDENT

INDEPENDENT

| | BIOGRAPHY | Mr. Dudley is Chairman of the international industry-led Oil and Gas Climate Initiative and Chair of the Accenture Global Energy Board, and has dedicated his career to the service of the international energy industry. He served as the Group Chief Executive of BP plc, a global energy provider, from 2010 until his retirement in March 2020. He was appointed to the board of BP in 2009 with accountability for the Americas and Asia, and previous executive roles with BP include Alternative and Renewable Energy activities and responsibility for BP’s upstream business in Russia, the Caspian region, and Africa. Mr.Dudley is a chemical engineer and a Fellow of the Royal Academy of Engineering. As the former CEO of a multinational oil and gas company, he has acquired extensive executive management experience and knowledge of the energy industry. He also has significant experience in strategic planning, risk management (including risks related to climate), international operations, and health, safety, and environmental and operations matters. | | | | COMMITTEES • Finance Committee (effective as of Annual Meeting)

• HSE&O Committee (effective as of Annual Meeting)

| | | | SKILLS AND QUALIFICATIONS | • •Public Company Director Experience

| • •International Operations

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS • Rosneft Oil Company (since 2013)

• Freeport-McMoRan Inc. (since 2021)

| FORMER PUBLIC DIRECTORSHIPS | • Freeport-McMoRan Inc. (since 2021) | • Rosneft Oil Company (2013-2022) | | | |

LYONDELLBASELL 2023 PROXY STATEMENT 14

Back to Contents CLAIRE FARLEY |

Age 62 64 American Non-Executive Director since 2014 INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Ms. Farley is ana former advisor to KKR Energy Group and a retired executive in the oil and gas exploration and production industry. Ms. Farley has served in several roles with KKR Energy Group sincefrom 2011 to 2021, including as Vice Chair from 2016 to 2017 and as a member of KKR Management LLC, the general partner of a global investment firm, from 2013 to 2015. Prior to joining KKR, Ms. Farley served as Chief Executive Officer of Randall & Dewey, an oil and gas asset transaction advisory firm. She became Co-President and then Senior Advisor at Jeffries & Company after Randall & Dewey became its oil and gas investment banking group, and then co-founded RPM Energy, a privately-owned oil and natural gas exploration and development company. Ms. Farley brings to the Board experience in business development, mergers, acquisitions, and divestitures, as well as knowledge of the chemical industry’s feedstocks and their markets. She also has experience in all matters of executive management and a deep understanding of public company and governance matters due to her current and prior service on the boards of companies including Anadarko Petroleum Corporation, Encana Corporation,Crescent Energy Company, and TechnipFMC. | | COMMITTEES | | • COMMITTEES

• Compensation and Talent DevelopmentAudit Committee

• •Nominating and Governance Committee (Chair)

| | | | SKILLS AND QUALIFICATIONS | • •Public Company Director Experience

| • •International Operations

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS • TechnipFMC plc (since 2017)

| FORMER PUBLIC DIRECTORSHIPS | • TechnipFMC plc (since 2017) • Crescent Energy Company (since 2021) | • Anadarko Petroleum Corporation (2017-2019) | | | |

• FMC Technologies, Inc. (2009-2017)RITA GRIFFIN

|  Age 60 American Non-Executive Director Nominee INDEPENDENT | BIOGRAPHY | Ms. Griffin served as the Chief Operating Officer of Global Petrochemicals at BP plc, one of three main divisions of BP’s downstream business, from 2015 to 2020. Previously, she served in a number of leadership positions within BP plc’s manufacturing, logistics, retail and functional organizations. Ms. Griffin began her career at Amoco and Standard Oil (Indiana), which was acquired by BP plc in 1998. With over 30 years of experience in global oil and gas and chemicals businesses, Ms. Griffin has considerable experience in developing and implementing strategies and leading substantial transformation programs. She has previously served on the board of directors of Royal Mail Group PLC, an international postal service and courier company. | COMMITTEES | | SKILLS AND QUALIFICATIONS | • Capital Project Execution • Public Company Director Experience | • International Operations | FORMER PUBLIC DIRECTORSHIPS | |

LYONDELLBASELL 2021 PROXY STATEMENT 16

• Royal Mail Group PLC (2016-2022) | | | |

LYONDELLBASELL 2023 PROXY STATEMENT 15

Back to Contents MICHAEL (MIKE) HANLEY |

Age 55 57 Canadian Non-Executive Director

since 2018

INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Mr. Hanley has more than 25 years of experience in senior management and finance roles, including as Chief Financial Officer of Alcan, a Canadian mining company and aluminum manufacturer, President and CEO of Alcan’s Global Bauxite and Alumina business group, and Senior Vice President, Operations & Strategy of the National Bank of Canada. He brings strong financial and operational experience, deep knowledge of capital-intensive and process industries, experience with U.S. and international accounting standards, and a broad understanding of international markets. Mr. Hanley also has significant experience on public company boards and in the role of audit committee chair, and an appreciation for corporate governance matters and the board’s role in financial oversight. He is currently a member of the Quebec Order of Chartered Professional Accountants. | | COMMITTEES | | • COMMITTEES

•Audit Committee (Chair)

• • HSE&OFinance Committee

| | | | SKILLS AND QUALIFICATIONS | • •International Operations

• •Public Company Director Experience

| | | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS • BRP, Inc. (since 2012)

• Nuvei Corporation (since 2020)

| FORMER PUBLIC DIRECTORSHIPS | • Nuvei Corporation (since 2020) | • Shawcor Ltd. (2015-2021) (until May 2021 annual meeting) • •Industrial Alliance Insurance & Financial Services (2015-2019)

• •Groupe Jean Coutu (PJC), Inc. (2016-2018)

| | | | |

Our Board has considered Mr. Hanley’s concurrent service on the audit committees of three additional public companies beginning in late 2020 and has determined that such simultaneous service does not impair his ability to effectively serve as a member and Chair of our Audit Committee. Mr. Hanley will not stand for re-election to the board of directors of Shawcor, where he currently serves on the audit committee. Following his departure in May 2021, he will only serve on two public company audit committees in addition to LyondellBasell.

ALBERT MANIFOLDVIRGINIA KAMSKY |  Age 69 American Non-Executive Director since2022 INDEPENDENT | BIOGRAPHY |

| COMMITTEES | | SKILLS AND QUALIFICATIONS | • Public Company Director Experience | • International Operations | OTHER CURRENT PUBLIC DIRECTORSHIPS | FORMER PUBLIC DIRECTORSHIPS | • Dana Incorporated (Since 2011) | • Kadem Sustainable Impact Corp. (2021-2023) | | | |

LYONDELLBASELL 2023 PROXY STATEMENT 16

Back to Contents ALBERT MANIFOLD |  Age 58 60 Irish Non-Executive Director

since 2019

INDEPENDENT INDEPENDENT

| | BIOGRAPHY | Mr. Manifold has been the Group Chief Executive and a director of CRH plc, an international group of diversified building materials businesses supplying the construction industry, since 2014. Mr. Manifold joined CRH in 1998 and advanced to increasingly senior roles, including Finance Director of the Europe Materials Division, Group Development Director, Managing Director of Europe Materials, and Chief Operating Officer (2009 to 2014). Prior to joining CRH, Mr. Manifold was Chief Operating Officer of Allen McGuire & Partners, a private equity group. As a sitting CEO with a background in other senior management roles, Mr. Manifold has acquired extensive leadership experience in competitive industries. In addition, he has significant knowledge of corporate finance, capital markets, strategic planning, and international operations. Mr. Manifold is also a Fellow of the Institute of Certified Public Accountants in Ireland. | | | | COMMITTEES • Audit Committee

• HSE&O Committee

• Finance Committee (until the Annual Meeting)

| | | | SKILLS AND QUALIFICATIONS | • •International Operations

| • •Capital Project Execution

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS | | | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 17

BHAVESH (BOB) PATELPETER VANACKER |

Age 5457 AmericanBelgian-German

Executive

Director

since

2018 2022

| | BIOGRAPHY | Mr. PatelVanacker has served as our Chief Executive Officer since January 2015. FromMay 2022. Mr. Vanacker previously served as the timePresident, CEO and Chair of the Executive Committee of Neste Corporation, a renewable products company, a position he joined the Company in 2010 untilheld since 2018. Prior to his appointmentrole at Neste, he served as CEO he held the rolesand Managing Director of Senior Vice President, OlefinsCABB Group GmbH, a fine chemicals producer, from 2015 to 2018 and Polyolefins–Americasas CEO and Managing Director of Treofan Group, a manufacturer of polypropylene films, from 2012 to 2015. He previously served as Executive Vice President Olefins and Polyolefins–Europe, Asia, International & Technology,Member of the Executive Board of Bayer Material Science (now, Covestro AG), a polymers and plastics producer, with additional responsibility for all manufacturing operations outside of the Americasglobal polyurethanes business and the Company’s polypropylene compounding business. Taken together with his prior positions of increasing responsibility at Chevron Corp.as Chief Marketing and Chevron Phillips Chemical Company,Innovation Officer. Mr. Patel has more than 30 years’Vanacker’s extensive experience in the chemicals, plastics,oil and refininggas and chemicals industries, including extensiveCEO and senior leadership experience, onprovide him with a global basis. This background gives him a detaileddeep understanding of the Company’s industriesindustry, operations, and operations.feedstocks. He also brings a strong understanding of circularity and sustainability issues. Mr. PatelVanacker also serves on the boards of the Houston Branch of the Federal Reserve Bank of Dallas, the Greater Houston Partnership, the Board of Visitors at the University of Texas MD Anderson Cancer Center, and isas a member of the Business Council. He is also on the external advisory council of the College of Engineering at The Ohio State University and theSupervisory Board of Visitors of the Fox School of Business at Temple University. Additionally, Mr. Patel serves as a director of Halliburton Company and previously served as a director of Union Pacific Corporation.Symrise AG. | | | | SKILLS AND QUALIFICATIONS | • •Corporate Finance

• Corporate Governance

• Public Company Director Experience

| • •Capital Project Execution

• •International Operations

• • International Business

•Mergers & Acquisitions

| | | | | OTHER CURRENT PUBLIC DIRECTORSHIPS • Halliburton Company (since 2021)

| FORMER PUBLIC DIRECTORSHIPS

• Union Pacific Corporation (2017-2021) (until May 2021 annual meeting)

| | | | | |

LYONDELLBASELL 2021 PROXY STATEMENT 18

LYONDELLBASELL 2023 PROXY STATEMENT 17

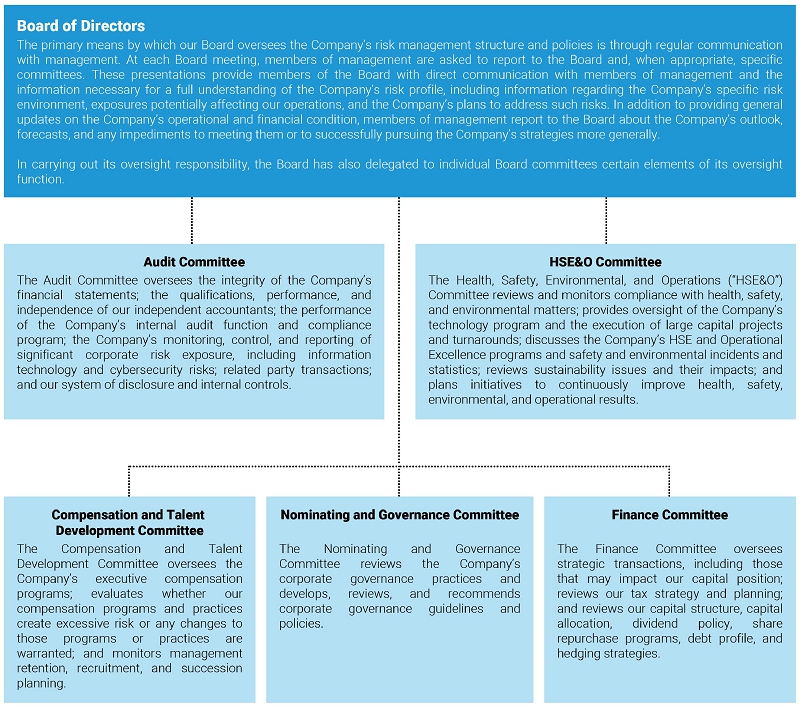

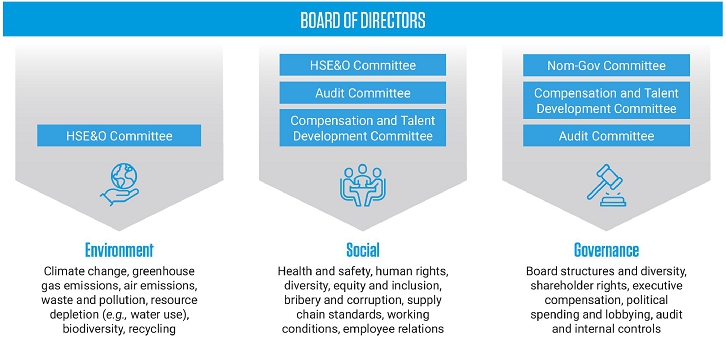

Back to Contents CORPORATE GOVERNANCEGOVERNANCELyondellBasell recognizes the importance of good corporate governance as a driver of long-term stakeholder value. Our Board has adopted, and regularly reviews and strives to improve upon, LyondellBasell’s robust corporate governance policies, practices, and procedures with consideration given to regulatory developments and evolving U.S. and Dutch governance best practices. Our governance guidelines and policies, including those listed below, are available on our website at www.LyondellBasell.comby clicking either (i) “Investors,” then “Corporate Governance” or (ii) “Sustainability,” then “Report and Policy Library.“Reporting.” DIRECTOR INDEPENDENCEOur Board annually reviews the independence of its members. In February 2021,2023, the Board affirmatively determined that all of our non-executive directors and director nominees are independent under the rules of the New York Stock Exchange (the “NYSE”). The Board has adopted categorical standards of independence that meet, and in some instances exceed, the requirements of the NYSE. In order to qualify as independent under our categorical standards, a director must be determined to have no material relationship with LyondellBasell other than as a director. The categorical standards include strict guidelines for non-executive directors and their immediate families regarding employment or affiliation with LyondellBasell and its independent registered public accounting firm. Our categorical independence standards are included in our Corporate Governance Guidelines. The Board has determined that there are no relationships or transactions that prohibit any of our non-executive directors or nominees from being deemed independent under the categorical standards and that each of our non-executive directors and nominees is independent. In addition to the relationships and transactions that would bar an independence finding under the categorical standards, the Board considered all other known relationships and transactions in making its determination, including those set forth belowreferenced under “–Other Governance Matters–Related Party Transactions.” In determining that no known transactions or relationships affect the independence of any of the non-executive directors, the Board considered that all of the identified transactions are ordinary course and none of the dollar amounts involved were material to the Company or the relevant counterparty. BOARD LEADERSHIP STRUCTUREJacques Aigrain has led our Board as its independent Chair since 2018. The Chair’s responsibilities include: ❙ Leading Board meetings and executive sessions | | Leading Board meetings and executive sessions | | | Reviewing and approving Board meeting agendas and schedules, and ensuring there is sufficient time for discussion of topics | | | Convening additional Board meetings, as needed | | | Facilitating information flow and communication among directors | | | Serving as a liaison between the independent directors and the CEO and other members of management | | | Together with the Compensation and Talent Development Committee, setting annual and long-term performance goals for the CEO and evaluating his performance | | | Presiding at general meetings of shareholders | | | Being available to meet with shareholders, when requested and as appropriate | | | Supporting the Company’s strategic growth initiatives |

❙ Reviewing and approving Board meeting agendas and schedules, and ensuring there is sufficient time for discussion of topics ❙ Convening additional Board meetings, as needed ❙ Facilitating information flow and communication among directors ❙ Serving as a liaison between the independent directors and the CEO and other members of management ❙ Together with the C&TD Committee, setting annual and long-term performance goals for the CEO and evaluating his performance ❙ Presiding at general meetings of shareholders ❙ Meeting or engaging with shareholders, as appropriate ❙ Supporting the Company’s strategic growth initiatives LYONDELLBASELL20212023 PROXY STATEMENT 1918

Back to Contents The Board regularly reviews LyondellBasell’s leadership structure and the responsibilities of its Chair, and may from time to time delegate additional duties to the role. Under Dutch law, only a non-executive director may serve as Chair of our Board. Our Board believes that the separation of the positions of Chair and Chief Executive Officer that results from this governance structure promotes strong Board governance, independence, and oversight. The separation of the two roles additionally allows Mr. Aigrain to focus on managing Board matters while our CEO, Mr. Patel,Vanacker, focuses on managing our business. EXECUTIVE SESSIONSExecutive sessions of our independent directors, with no members of management present, take place at every regularregularly scheduled Board and committee meeting. During executive sessions, independent directors have an opportunity to meet with the Board’s outside consultants and independent accountants and review and discuss any matters they deem appropriate, such as the performance of the Chief Executive Officer and other members of management and the criteria against which performance is evaluated, including the impact of performance on compensation matters. Mr. Aigrain leads these executive sessions of the Board. If he is unavailable, the non-executive director with the longest tenure will preside. If two or more individuals have equal tenure, the eldest of them will chair. BOARD EVALUATIONSOur Board and its committees evaluate their own effectiveness by participating in a robust annual self-assessment process overseen by the Nominating and Governance Committee. Each year, directors respond to survey questions soliciting information used to improve the effectiveness of the Board and its committees and individual directors. Survey results are supplemented by one-on-one interviews conducted by either the Chair or third parties, and theThe Nominating and Governance Committee periodically engages independent outside consultants, including most recently in 2020, to facilitateconduct interviews with the Board and refreshfacilitate the evaluation process. The Nominating and Governance Committee intends to continue engaging third parties periodically in order to refresh and bring an outside perspective to the evaluation process. For 2020,2022, the Board conducted its evaluation process as described below. Engagement of Independent Outside Consultant1 | In early 2020, the Nominating and Governance Committee engaged an independent outside consultant to lead the self-assessment process and facilitate individual director interviews. The same consultant also administered the Company’s 2017 assessment cycle, allowing for continuity and observations regarding improvement in Board processes and effectiveness over recent years. | Development and Approval of Evaluation Process and Topics | In September 2020,2022, the Nominating and Governance Committee discussed and approved the overall process and timeline for the 20202022 evaluation cycle, including one-on-one interviews with the consultant based on agreed interview and survey questions.cycle. The Chair of the Nominating and Governance Committee andapproved the Company’s Chief Legal Officer worked with the consultant to develop suggested topics and questions for distribution to the individual Board members, whichmembers. Questions were approved bylargely consistent with those used in prior cycles, with the Nominatingaddition of questions to cover topical matters and Governance Committee in November. | The Board member interviews included an evaluationdeletion of each individual director’s contributions to the Board and its committees, including his or her availability and time commitment, communication, understanding of relevant business and regulatory issues and ESG issues and trends, and functional expertise, as well as topicsquestions related to the functioning ofpandemic and CEO selection process. As in prior cycles, the Board and its committees as a whole (Board meetings, director training and education, and Board refreshment).Committee approved an individual evaluation process for the Chair, to be facilitated through survey questions specific to his role. | 2 | Distribution of Surveys and Interview Process | In late 2020,2022 and early 2023, Board members participated in one-on-one interviews withprovided responses to the consultant. surveys anonymously. In parallel, senior executives provided their views of Board effectiveness and interactions with management through confidential interviewssurvey responses provided to the Corporate Secretary. Key areas covered in the Board and committee surveys include membership; responsibilities; functionality; meetings; strategy; senior management (including succession planning); focus on performance; ensuring financial robustness; building corporate reputation; and matching risk with return. Committee members are also asked to consider whether each committee is functioning in compliance with its charter and keeping the consultant.Board adequately informed, and to review the committee’s member skill sets and leadership. Survey questions for the individual Chair assessment focused on effective management of meetings and facilitation of constructive relationships and communication among Board members and with management. | 3 | Reporting and Board Review of Results | The independent consultant prepared a report with findings and suggestions to enhance Board effectiveness and best governance practices. The conclusions of that report,Corporate Secretary compiled feedback from the self-evaluation process, including feedback from senior executives, werewhich was discussed during the February 2021 Nominating and Governance Committee2023 committee and Board meetings in executive sessions. | 4 | Response to Director Assessment | Policies and practices were evaluated based on the self-assessment results. results to consider potential enhancements to Board processes and identify the most effective existing practices. The Nominating and Governance Committee also considered director feedback in recommending the nomination of continuing directors for reelection. Feedback from the process will also be used to refresh the evaluation process and adjust areas of focus for surveys used in 20212023 and future assessments. The Nominating and Governance Committee intends to continue engaging third parties periodically in order to bring an outside perspective to the evaluation process. |

LYONDELLBASELL20212023 PROXY STATEMENT 2019

Back to Contents DIRECTOR ONBOARDING, TRAINING, AND SITE VISITSOur Board is committed to understanding its governance responsibilities, evolving best practices, and all aspects of our Company and business. The Company provides an extensive orientation program that enables each new director joining the Board to become familiar with LyondellBasell and to meet with key members of the Company’s management and functional leaders. Mr. Hanley and Mr. Manifold, who joinedAll of our Board in 2018 and 2019, respectively, completednon-executive directors complete our onboarding program and metmeet with the Company’s Chief Executive Officer, Chief Financial Officer, Chief Legal Officer,General Counsel, Chief Compliance Officer, Executive Vice President, Sustainability and Corporate Affairs and additional executives to discuss our corporate structure, business strategy, operations, and segments, as well as tax, accounting, compliance, investor relations, human resources, tax, accounting, and health, safety, and environment (HSE) matters, including sustainability reporting, among other topics. Mr. Chase and Mr. Dudley will complete a similar orientationMs. Griffin completed our onboarding program prior to joining our Board.her nomination and has attended Board and Committee meetings as an observer since November 2022. All of our directors are encouraged to participate in industry and governance organizations and seek out training opportunities that will provide them with continuing education on key topics. The Company will reimburse directors for the costs of such continuing education. During Board meetings, our directors hear from management on a wide range of subjects, including regulatory developments, shareholder updates, and environmental, social, and corporate governance issues and trends. Our directors also have regular opportunities to visit the Company’s manufacturing and technology centers and meet with site management. During 2022, multiple members of our Board toured the Company’s propylene oxide and tertiary butyl alcohol (PO/TBA) plant construction site at Channelview. In early 2020, theaddition, Mr. Bindra, Chair of the HSE&O&S Committee, also visited two manufacturing facilities within our Advanced Polymer Solutions segment. Although a groupFerrara, Italy site visit could not be arranged for 2020 given travel restrictions related to COVID-19, the Board has toured the Company’s Cincinnati Technology Center and Hyperzone plant construction site in recent years.Technical Center. SHAREHOLDER ENGAGEMENTWe recognize the value of regular and consistent communication with our shareholders and engage with investors on strategy, risk management, sustainability, corporate governance, executive compensation, and other matters. We regularly review general governance trends and emerging best practices and invitewelcome feedback from our shareholders and other stakeholders, which is brought to our Board and part ofhelps inform its decision-making process.process and understanding of corporate governance trends and best practices. Engagement with shareholders occurs in one-on-one meetings and calls with shareholder representatives, at our annual general meeting of shareholders, and through our regular participation in industry conferences, investor road shows, and analyst meetings. In 2020,2022, we engaged an external advisory firm to evaluate our investor relations and engagement strategy, identify shareholder priorities, and address opportunities for growth. In addition, throughout the year, we discussed the Company’s strategy and environmental, social, and governance profile with multiple investors and engaged their questions or concerns on these and other topics. Our Chief Sustainability Officer regularly joins meetings to discuss our climate and sustainability ambitions. In addition, our independent Board Chair has made himself available forjoined these discussions and managementwhen requested. Management updates the Board regularly on conversations with shareholders and feedback received. We are committed to remaining proactive in our engagement efforts and shareholder outreach. LYONDELLBASELL2021 PROXY STATEMENT 21

COMMUNICATION WITH THE BOARDShareholders and other interested parties may communicate with the Board or any individual director. Communications should be addressed to our Corporate Secretary by email or regular mail. Communications are distributed to the Board or to one or more individual directors, as appropriate, depending on the facts and circumstances outlined in the communication. Communications such as business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; and resumes and other forms of job inquiries will not be relayed to the Board. In addition, material that is unduly hostile, threatening, illegal, or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any director upon request. |  |   BY EMAIL | BY EMAIL

send an email to

CorporateSecretary@

LyondellBasell.com | |  BY MAIL

| | LyondellBasell Industries N.V.

c/o Corporate Secretary

4th Floor, One Vine Street

London W1J 0AH, United Kingdom |

LYONDELLBASELL 2023 PROXY STATEMENT 20

Communications are distributedBack to the Board or to one or more individual directors, as appropriate, depending on the facts and circumstances outlined in the communication. Communications such as business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; and resumes and other forms of job inquiries will not be relayed to the Board. In addition, material that is unduly hostile, threatening, illegal, or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any director upon request.Contents

CEO AND MANAGEMENT SUCCESSION PLANNINGOne of the primary responsibilities of the Board is to ensure that we have a high-performing management team in place. On an annual basis, the Board conducts a detailed review of development and succession planning activities to maximize the pool of internal candidates who can assume executive officer positions without undue interruption. The Board reviews CEO and executive succession planning and ensures that executive officer reviews and evaluations are conducted at least annually by either the CompensationC&TD Committee and Talent Development Committee or the Board as a whole. The Board also reviews in-depth assessments of the Company’s bench strength, retention, progression, and succession readiness for all other senior level managers. In August 2021, our former CEO gave notice of his intention to retire from LyondellBasell at the end of 2021. Our Board acted swiftly to organize a Selection Committee and execute on existing leadership development and succession plans to appoint Kenneth Lane, our EVP, Olefins and Polyolefins, as interim CEO effective January 1, 2022. In late 2021 and early 2022, the Board completed a thorough CEO selection process that resulted in the appointment of Peter Vanacker as the Company’s new CEO effective May 23, 2022. In 2022, the Company successfully executed the CEO and senior leadership transition as a result of the succession planning process that the Board undertook starting in 2021. As part of our leadership transition, the Company launched a comprehensive strategic review of its businesses, which resulted in, among other strategies, the creation of a new business unit for Circular and Low Carbon Solutions. To align our leadership with our evolving vision and strategy, we welcomed Yvonne van der Laan as our EVP of Circular and Low Carbon Solutions, Tracey Campbell as our EVP of Sustainability and Corporate Affairs, and Trisha Conley as our EVP of People and Culture. Monitoring the Company’s leadership development, talent management, and succession planning is also a key responsibility of our Compensation and Talent DevelopmentC&TD Committee, which devotes significant time to discussion and oversight of the Company’s human resources strategy. In connection with the 2020 retirement of the Company’s Executive Vice President, Global Manufacturing, Projects, Our strategy includes efforts to hire, retain, and Refining, the Company re-allocated significant responsibility to other members of its senior executive team in accordance with existing leadership developmentfairly compensate a diverse and succession plans.

LYONDELLBASELL2021 PROXY STATEMENT 22representative workforce.

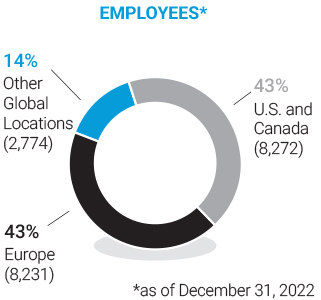

HUMAN CAPITAL MANAGEMENTOur success as a company is tied to the passion, knowledge, and talent of our global team. To achieve our vision of being the best operated and most valued company in the industry, we must attract top performers and equip them with the tools needed to continuously grow and leverage their potential. What We Do | |  |   | We believe in integrity, diversity, and fairness | |   | We focus on creating a work environment that is safe, respectful, and inspires employees to strive for excellence | |   | We believe in the "power“power of many"many” and place a strong emphasis on teamwork | |   | We reward performance based on personal, team, and company results | |   | We engage in open and ongoing dialogue with employees and their representatives to ensure a proper balance between the best interests of the Company and its employees | |   | We have a comprehensive Human Rights Policy, available on our website at www.LyondellBasell.com by clicking “Sustainability,” then “Report and Policy Library”“Reporting” | | | | | |

Key 20202022 Focus AreasWORKPLACE FLEXIBILITYIn 2020,We continued to support workplace flexibility in 2022 as a result of feedback we received from employees expressing a desire for more flexible work policies. While the easing of governmental restrictions related to the COVID-19 pandemic has alleviated the need for remote working, employees have appreciated and embraced this flexibility. Based in part on data from employee surveys, we enhanced our workplace flexibility initiative in early 2023 by offering up to three remote days per work week to employees whose job duties can be performed remotely as determined by the Company. These changes have helped to attract and retain employees in a competitive market for talent. We will continue to study the effectiveness of this policy and will make changes, where necessary, to support business needs.

LYONDELLBASELL 2023 PROXY STATEMENT 21

Back to Contents DIVERSITY, EQUITY, AND INCLUSIONDEI remained a key focus in 2022. Our efforts reflect a holistic, multi-year strategy to improve representation, ensure fairness, and increase visibility and accountability to leadership. Diversity The percentage of diverse employees on our Executive Committee, comprised of senior executives who lead LyondellBasell’s businesses and functions and report directly to our CEO, increased from 18% in 2021 to 33% in 2022, and as of February 2023, has increased to 40%. Of the ten members on our Executive Committee, four are women, and together, our CEO and Executive Committee represent six different nationalities. This increase brings us closer to our long-term goals of achieving gender parity (approximately 50% women and 50% men) in global senior leadership. We are also committed to increasing the number of underrepresented senior leaders (“URP”) in the U.S. to reflect the general population ratio by 2032. To meet these targets, we have set short-term goals to increase the number of female senior leaders globally and the number of underrepresented senior leaders in the U.S. by 50% by 2027, relative to a 2022 baseline, to at least 30% women and 30% URP. These ambitious goals demonstrate our commitment to having a diverse group of company leaders. To achieve these goals, we focused on enhancing our hiring, promotion and retention practices. With respect to hiring, we expanded our existing senior-level hiring practices to a larger group of positions. These practices include broader recruiting efforts, diverse interview panels and candidate slates, standardized interview questions and hiring-manager training. With respect to promotions, we launched a new program in partnership with McKinsey to help diverse employees advance their leadership skills. We also continued to develop and improve our focusinternal talent programs as discussed below. Through these efforts, we promoted 16% more women in 2022 than in 2021. Indeed, increased promotions of women were the main reason the number of women in senior leadership globally increased by 1% to 22% in 2022. While we are making significant efforts, our progress towards our goals in 2022 was negatively impacted by increased attrition of both women and URP leaders. Despite increased hiring and promotions of URP employees, the number of URP senior leaders in the U.S. decreased by 1% from 19% in 2021 to 18% in 2022. We continue to analyze retention issues to understand attrition drivers and to enhance our employee engagement efforts. Other factors impacting our results were the challenging external talent market and the addition of new senior leadership roles due to the Company’s growth initiatives. We recognize that building talent pipelines and transforming culture takes time, and we remain committed to frequently assessing outcomes and developing programs that will advance these goals. Equity For the second consecutive year, the Company completed a pay equity review and performance analysis. Our pay equity review compared pay for like jobs and specifically focused on base pay for gender (globally) and ethnicity (U.S. only). Consistent with 2021 findings, the review reflected that pay is generally administered fairly, with a small number of exceptions that should be remediated by the second quarter of 2023. We also confirmed that performance appraisals are generally administered fairly. Both of these annual review processes are now embedded in our HR processes. The Company also implemented several practices to advance pay equity, including: 1. Ensuring that job offers are based on the role, market competitiveness, and a candidate's level of proficiency and experience and not based on a candidate’s historical compensation; 2. Modifying promotion practices to ensure pay fairness is applied consistently for internal candidates compared to external hires; 3. Helping line managers conduct an internal equity review for their employees and, when necessary, making compensation adjustments; and 4. Establishing a consistent framework for recognizing and retaining employees. Finally, we conducted stakeholder workshops to strengthen our approach to pay equity and provide increased transparency to employees about pay practices. Inclusion We advanced our inclusion efforts by increasing the number of global employee networks from four to six, building an engaged, talenteda global diverse network of employees championing inclusion. The new networks, Global Asian/Pacific Islander and Global Latin, were chosen based on employee input and opportunities to improve inclusion within our workforce. Executive leaders serve as active sponsors for each network, and about 15% of our global workforce by developing skill sets, supporting diversity, and ensuring fair employment and work practices. COVID-19

As caseshas joined at least one of our employee networks. We have network members present at 92% of our global sites, with 47% of members residing outside of the COVID-19 virus spread acrossU.S. and 28% joining as allies of underrepresented groups. Network programming is strongly tied to career development and business and community impact, including engagement in strategy development activities with executives in 2022.

DEI training continues to play an important role in aligning our culture to our values. In 2022, 32% of employees (6,235) completed 17,419 DEI-related trainings. We assigned at least one mandatory training session to 1,320 people leaders, and another 4,915 employees completed these DEI courses voluntarily. We are on track for our manufacturing front line employees to complete required DEI training by the globe, LyondellBasell continuedend of 2023. Based on our 2022 employee engagement survey results, the gap in satisfaction in between our URP employees and non-URP employees has narrowed since 2020, with significant improvement among our Black employees. LYONDELLBASELL 2023 PROXY STATEMENT 22

Back to operate with threeContents GLOBAL TALENT DEVELOPMENTSupporting employee growth and development remains a key objectives: protectingfocus for the health and safetyCompany. In 2022, we launched a new e-learning platform that provides learning opportunities for employees globally. 31% of our people; ensuringworkforce is enrolled in the safetyprogram and securityhas completed more than 10,000 training hours aimed at increasing business, technology and personal development skills. We also launched LyondellBasell University, a platform which provides learning and development resources to help employees advance their capabilities and unlock their potential. In addition, our Engineer U program also provides in-person and virtual classes to our global engineering workforce, and our Young Engineer Program in Europe provides our talented engineers with rotational and developmental opportunities. In 2022, four new engineers were onboarded into the Young Engineer Program, and 19 young engineers attended an internal learning forum. Leadership training was provided to leaders at various levels in the Company, including 262 first-time leaders who participated in a program to help them transition effectively into leading others, 116 middle managers who participated in an interactive 3-month classroom program to advance their coaching skills, and 96 senior leaders who completed an intense 5-day university program to equip them to lead our business initiatives. To prepare our leaders for advancement to larger roles, we tripled participation in our executive mentoring and peer learning programs. In addition, we expanded quarterly talent reviews to lower management levels to drive more internal promotions and help leaders improve how they attract, develop and retain employees. As a result of this focused approach, about 83% of our openings in senior leader roles were filled by internal talent, underscoring our commitment to advancing talent from within the Company. Finally, we launched new reward programs to recognize and retain key employees. In 2022, significant effort was made to survey employees and apply these insights to continuously improve our work locations;environment. Nearly 13,000 employees completed our engagement survey in June 2022. To collect more detailed feedback, 399 employees across 21 sites globally participated in confidential interviews. Overall, our employee engagement score was high, with 83% of employees responding favorably. Compared to the last survey in 2020, our scores related to sustainability, DEI, compensation, learning and maintaining business continuityperformance management programs improved, and we did not see significant declines in any area. Senior management reviewed these results, which are used to continually improve talent development, employee advancement, DEI and workplace flexibility programs. LYONDELLBASELL 2023 PROXY STATEMENT 23

Back to Contents APPROACH TO SUSTAINABILITYLyondellBasell is taking action to help tackle the global challenges of eliminating plastic waste, addressing climate change, and supporting a thriving society. As one of the world’s largest producers of plastics and chemicals, we have the potential — and responsibility— to use our scale and reach to make a positive impact across value chains. We are working to deliver meaningful progress to address some of the world’s most pressing challenges such as helping end plastic waste in the environment, mitigating climate change and contributing to a thriving society for our employees, the communities where we operate and the people who depend on our products. 2022 Actions and MilestonesIn addition to defining our longer-term sustainability priorities, we are taking substantive action to achieve those goals. Noteworthy initiatives and accomplishments during 2022 are highlighted below, as well as in the Company’s annual Sustainability Report, available on our website at www.LyondellBasell.com by clicking on “Sustainability,” then “Reporting.” Our Sustainability Report also includes our sustainability disclosures under the Global Reporting Initiative (“GRI”), the Sustainability Accounting Standards Board (“SASB”), and the Task Force for Climate-Related Financial Disclosures (“TCFD”). For more information about how our sustainability actions and milestones impact executive compensation, see the section titled “2022Executive Compensation Decisions in Detail—2022 Annual Bonus Payments—Sustainability” on page 53. LYONDELLBASELL 2023 PROXY STATEMENT 24

Back to Contents INCREASED 2030 EMISSION REDUCTION GOALSIn December 2022, we stepped up our ambitions to reduce greenhouse gas (GHG) emissions from global operations, increasing our 2030goal for scope 1 and scope 2 reductions from 30% to 42%, relative to 2020. We also announced a new 2030 goal to reduce scope 3 emissions by 30%, relative to 2020 and in accordance with guidelines from the Science Based Targets Initiative. We remain committed to procuring at least 50% of our electricity from renewable sources by 2030. These targets are consistent with efforts to support the Paris Agreement’s goal of limiting climate change by achieving net zero for global GHG emissions by mid-century. As of March 2023, LyondellBasell has signed 13 renewable electricity PPAs, which will reduce our scope 2 emissions by more than 1 million metric tons of GHG emissions. Through these agreements, we have achieved 70% of our target to procure at least half of our global electricity from renewable sources by 2030. In the near to medium term, we continue to execute our previously announced initiatives to reduce emissions, including: ❙ Phasing out use of coal at our Wesseling, Germany site, reducing scope 2 emissions by about 170 thousand metric tons annually; and ❙ Closing our Houston refinery, anticipated by the end of December 2023, further reducing scope 1 and scope 2 GHG emissions by more than 3 million metric tons annually and scope 3 emissions by approximately 40 million metric tons annually. In the long term, our pathway to achieve net zero includes enhanced energy management; low emission steam; flare minimization; use of lower-emitting fuels; process electrification; furnace upgrades; and carbon capture, storage, and utilization. We continue to engage with our customersshareholders and suppliers. A globally coordinated, locally implemented planother stakeholders to protectunderstand their priorities, concerns, and insights regarding our workforce was quickly put in place at the beginning of the pandemic. Strict social distancingclimate strategy and facial coverage protocols were introduced, critical personal protective equipment was procuredgoals.

RECYCLING AMBITION AND CIRCULENIn 2022, we launched our new Circular and provided to employees, and a number of initiativesLow Carbon Solutions business to support our employees’ mental health were putambition to produce and market two million metric tons of recycled and renewable-based polymers annually by 2030. We continue to invest in our suite of Circulen products, which support the reduction of plastic waste through the use of recycled content, and are focused on growing sales of Circulen products globally and across our business segments. In furtherance of this goal, we announced plans to form joint ventures to build and operate plastics recycling plants in China and India, expected to come online in 2023 and 2024, respectively. The recycled products produced by these joint ventures will be marketed through our Circulen Recover product portfolio to help meet increasing global demand for sustainable solutions. We also formed a joint venture, Source One Plastics, to build an energy efficient, advanced plastic waste sorting and recycling facility in Germany. The Source One Plastics facility will provide feedstock to our new advanced recycling plant in Wesseling, Germany, which will convert pre-treated plastic waste into place. Processes and tools were implemented so employees could easily and confidentially report if they have symptoms of, or have tested positivefeedstock for COVID-19; all are contacted by medical personnel or human resources to ensure they have sufficient support. new plastic production using our proprietary MoReTec technology. In addition, the COVID-19 pandemic required our office-based workforcewe are exploring a collaboration with Cyclyx International and ExxonMobil to quickly shift to remote working. To date, many employees continue to work from home for various pandemic-related reasons, including back-to-school and childcare challenges as well as personal or health-related reasons. We have also increased the availability of virtual learning and development opportunities. DIVERSITY, EQUITY, AND INCLUSION

In July 2020, we accelerated our efforts in the area of diversity, equity, and inclusion (DEI) with the appointment of a Chief Talent & Diversity Officer, the establishment of a DEI Leadership Council, and theadvance development of a multi-year DEI strategy. first-of-its-kind plastic waste sorting and processing facility in the Houston area. The new facility would address a critical missing link in the plastic waste supply chain by connecting community recycling programs to new and more advanced recycling technologies that have the potential to take a much wider variety of plastic materials. In 2023, we are continuing to explore additional joint venture opportunities and collaborative endeavors.

SUSTAINABLE SUPPLY CHAINLyondellBasell has been awarded a Gold Medal for our 2022 Sustainability Rating from EcoVadis, a recognized global provider of corporate social responsibility and sustainability assessments. This award places us in the top nine percent of companies globally in our industry rated by EcoVadis for their overall sustainability performance. As part of our sustainable procurement program in 2022, we engaged EcoVadis to assess the sustainability performance of almost 700 LYB suppliers, driving a 10-point improvement in the Sustainable Procurement pillar of our Sustainability Rating. We also updated our Supplier Code of Conduct and sustainability clauses in our Purchasing General Terms & Conditions to enhance ESG practices throughout our supply chain. We are launching new employee initiativesa member of Together for Sustainability (TfS), a global network of chemical companies focused on obtaining our employees’ perspectives on DEI, including formalized employee inclusion groupsassessing, auditing and improving sustainability practices within their global supply chains. In 2022, we collaborated with other industry leaders to develop a seriesglobal standard for product carbon footprint (PCF) calculation, which will allow chemical companies to calculate scope 3 greenhouse gas emissions across their supply chains and track performance against TfS's PCF guideline. We are also part of employee “listening circles,”a TfS pilot program to implement a standard PCF data collection and providing DEI training to all employees and senior managers.sharing platform. HEALTH, WELLNESS, WELFARE, AND FAMILY RESOURCES

We provide competitive benefits and, at our large sites, access to health services at an on-site clinic on paid worktime. We have defined benefit pension plans that cover employees in the U.S. and various non-U.S. countries. In addition, we provide other post-employment benefits such as early retirement and deferred compensation severance benefits to employees of certain non-U.S. countries.